santa ana tax rate

In California your property tax rate may differ. A yes vote supports restructuring non-cannabis business license tax rates.

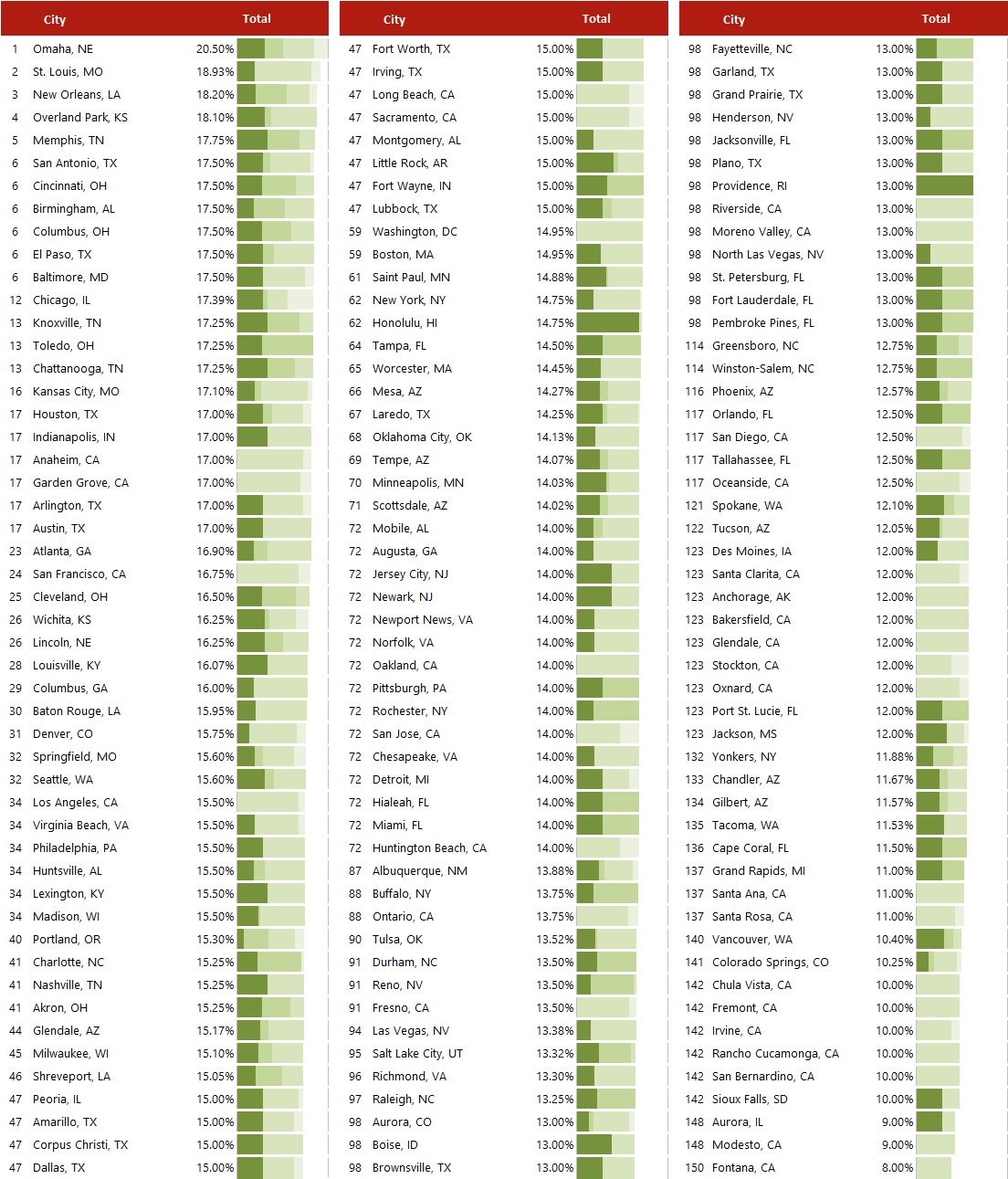

Hvs 2020 Hvs Lodging Tax Report Usa

Santa Ana voters will be asked in November to consider a ballot measure officials say would restructure the citys business tax rate shifting the tax burden from small.

. 15 for Santa Ana Tax. Request an Extension or Relief. A no vote opposes.

This is the total of state county and city sales tax rates. New Sales and Use Tax Rates Operative April 1 2019 The tax rate changes listed below apply only within the indicated city or county limits. Identify a Letter or Notice.

025 lower than the maximum sales tax in CA. 925 Highest in Orange County 725 for State Sales and Use Tax. The current total local sales tax rate in Santa Anna TX is 8250.

The December 2020 total local sales tax rate was also 8250. The average cumulative sales tax rate in Santa Ana California is 925. The current total local sales tax rate in Santa Ana Pueblo NM is 63750.

1788 rows Find Your Tax Rate. Business License Tax Fee Schedule Flat Rate ENG. What is the sales tax rate in Santa Ana California.

The local sales tax rate in Santa Ana Puerto Rico is 925 as of August 2022. California CA Sales Tax Rates by City S The state sales tax rate in California is 7250. The budgettax rate-determining process usually gives rise to customary public hearings to discuss tax rates and related budgetary questions.

05 for Countywide Measure M Transportation Tax. The minimum combined 2022 sales tax rate for Santa Ana Pue New Mexico is. The new tax rates tax codes acronyms and.

Santa Ana is located within Orange County California. The estimated 2022 sales tax rate for 92705 is. Santa Ana Measure W is on the ballot as a referral in Santa Ana on November 8 2022.

Has impacted many state nexus laws and sales tax collection. Register for a Permit License or Account. The New Mexico sales tax rate is currently.

The 2018 United States Supreme Court decision in South Dakota v. With local taxes the total sales tax rate is between 7250 and 10750. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Santa Ana California is. Keep in mind that under state law. The 925 sales tax rate in Santa Ana consists of 6 California state sales tax 025 Orange County sales tax 15 Santa Ana tax and 15.

This includes the rates on the state county city and special levels. The median home value in Santa Ana the county seat in Orange County is 455300 and the median property tax payment is 2943. The December 2020 total local sales tax rate was also 63750.

Manager Ims Salary In Santa Ana Ca Comparably

Santa Ana Officials Set 1 7 Million Car Dealership Subsidy To Help Local Business

![]()

How Much Are Property Taxes In Orange County California

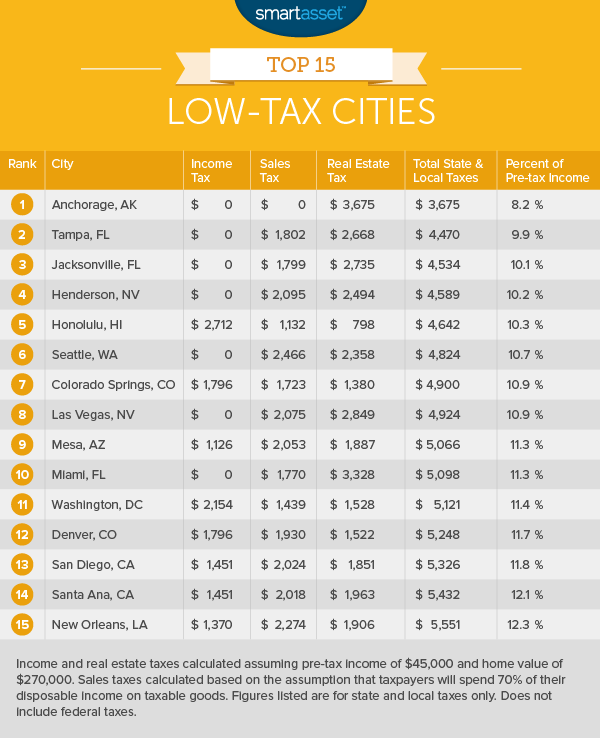

The Lowest Taxes In America Smartasset

Sal Tinajero Is Trying To Raise Taxes In Santa Ana Again New Santa Ana

Orange County Property Tax Oc Tax Collector Tax Specialists

Why Remote Workers Should Ditch Santa Ana Ca In Favor Of Plano Tx

Orange County Ca Property Tax Calculator Smartasset

Orange County Ca Property Tax Calculator Smartasset

Ca Sales Tax Rate Increase Operative April 1 2017

Santa Ana Register From Santa Ana California On August 23 1934 Page 13

Santa Ana California Ca 92701 92707 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

California Income Tax Calculator Smartasset

Cornerstone Affordable Housing Development Partner In Santa Ana

Food And Sales Tax 2020 In California Heather

Santa Ana Bankruptcy Lawyers Affordable Debt Consolidation Solutions

California Sales Tax Calculator And Local Rates 2021 Wise